Now is the time for brands to elevate the innovation game

With nearly three-quarters of respondents indicating they would be putting more resources toward product innovation in 2024, TraceGains’ annual R&D and Product Innovation in the Food and Beverage Industry Report highlights a renewed appetite for innovation.

This builds on similar data collected by the networked ingredient marketplace in 2023, which suggested the pressures of the pandemic and accompanying supply chain disruptions was easing. However, the new data has yielded a few interesting takeaways, especially in light of broader industry events and trends.

Some takeaways:

- 76% of brands are planning to increase their investment over last year, an increase of 12%.

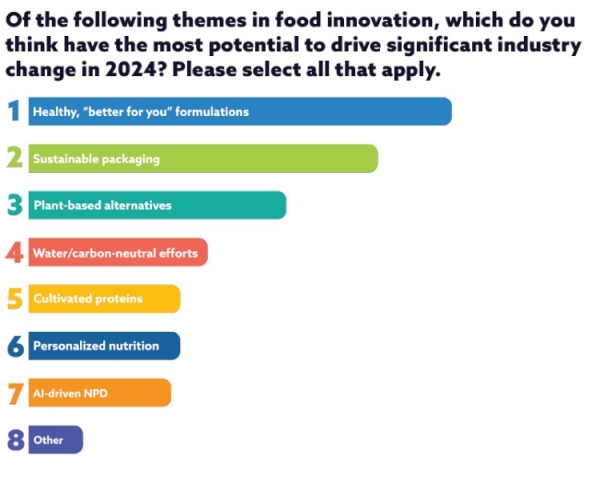

- 42% cite evolving consumer preferences for healthier products as a primary reason for increasing investment in NPD.

- 60% think better-for-you formulations have the most potential to drive industry change this year.

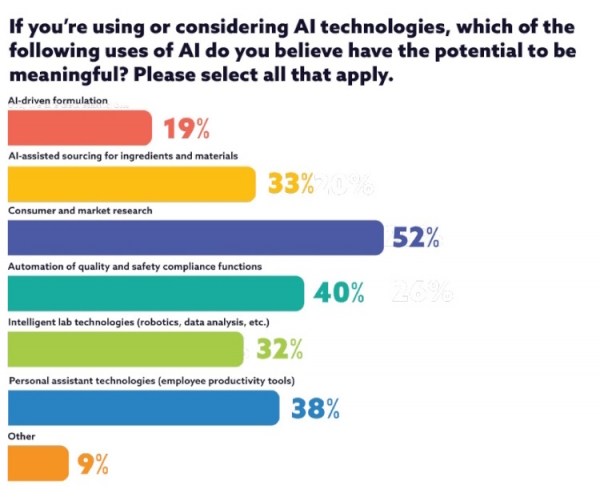

- To keep up, 53% are considering AI for sourcing ingredients and materials and formulating product, while 36% are actually testing the AI waters.

- Food fraud and concerns over tainted ingredients drove 44% to place greater emphasis on supply chain traceability in 2024.

- Following a rise in ESG awareness last year (64% in the August 2023 report), brands are walking the talk this year, with 44% prioritizing supply chain traceability and 42% using sustainable ingredients.

A convergence of factors

The uptick in NPD doesn’t have appear to have a single, unified cause, said TraceGains, but a multitude of factors at play.

Not surprisingly, in the lead, but only just, is competitive pressure, with 51% of respondents listing competitors as a key driver of staying ahead of the game.

Also, with social media and other channels giving consumers greater access to info than ever before, preferences are developing and shifting more rapidly than ever before. This means brands have to be agile and motivate to continually attract increasingly fickle consumer attention.

Another extremely notable driver for innovation is cost.

With manufacturing unit labor costs climbing every quarter in 2023 – alongside continued price hikes on food ingredients, transportation and energy, among others – it’s not surprising that 46% want to adopt more innovative approaches to reduce ingredient and manufacturing costs.

Surprisingly, inflation – particularly rising costs of materials and ingredients – is actually driving innovation in the CPG space, Paul Bradley, senior director of Product Marketing at TraceGains, told Bakery&Snacks.

“Our survey found that 46% of respondents identified cost reduction as a key motivator for product development this year. This translates to brands reformulating products to be more cost-effective. These changes can range from adapting a recipe using less expensive materials, or changes to support lower-cost, or more energy-efficient, production processes.”

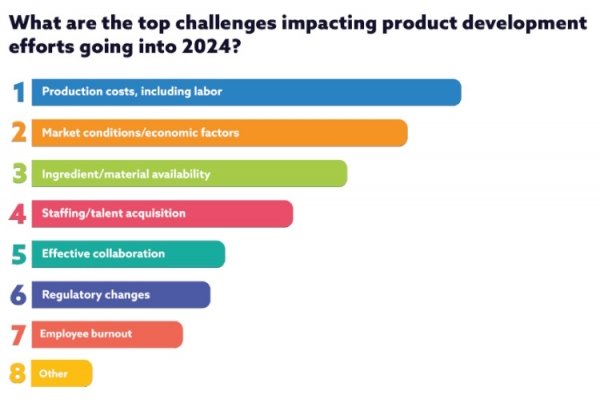

Despite the enthusiasm for NPD, brands are troubled by macroeconomic forces beyond their control.

While industry-wide costs could prompt innovation, they’re also seen as a hurdle, with 58% of respondents citing rising production and labor costs as key concerns looking into 2024. 53% are concerned about fluctuating demand and commodity costings, and 46% see the availability of ingredients and materials as their biggest obstacle.

According to TraceGains, nearly half of survey respondents identified efforts to reduce ingredient or production costs as both a top driver and a significant challenge for product development. These efforts can take many forms, from reformulation to leverage lower cost ingredients to changes necessary to adapt to more efficient production methods. R&D teams in 2024 can expect to play an increasingly important role in both top-line revenue and bottom-line profitability.

56% reported a lack of tools to ensure success, “referring to a broad range of digitization and automation tools, particularly those that help manage ingredients and recipes automatically,” said Bradley.

Though not as high up at competition and consumer factors, brands are increasingly facing a complex and confusing patchwork of regulations.

In the US, state regulations are moving faster than FDA regulations in terms of food safety and additive restrictions, while across the pod, a host of European Union directives, both current and pending, pose potential compliance challenges for international brands; made all the more complicated by the long legacy of Brexit.

AI and brand development

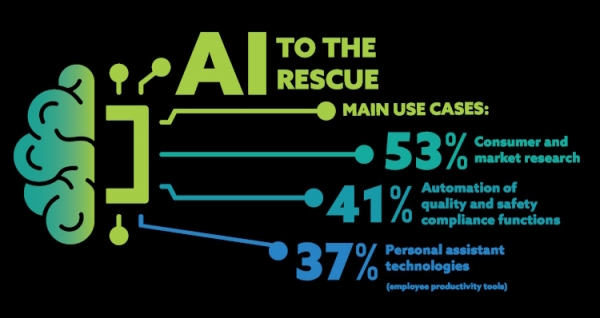

The initial flush of excitement around generative AI is giving way to a more measured assessment and brands are proceeding with caution. While survey respondents are considering a range of potential use cases for AI, only a minority are to-date fully invested in the technology, with just over 10% indicating a definite commitment to AI and 37% testing the waters.

Heading into 2024, a number of AI-related technologies are already in place within the food and beverage space, such as machine learning, pattern recognition techniques and the use of AI-assisted character recognition tools to automatically read and analyze documents. The questions seem to be hovering around the potential of generative AI technologies to impact areas such as product formulation, supply chain optimization and sourcing, and consumer research.

“The survey suggests a growing interest in AI for market research and efficient sourcing, rather than high-profile areas like AI-driven formulation,” said Bradley.

“Our perspective on AI is that it’s only as powerful as the data that it has to work with, and it appears that using AI to interpret and identify patterns in large, complex industry data sets is likely to be a very dynamic area of technical innovation in the year to come.”

Ingredients and ESG

We asked Bradly what ingredients TraceGains has noticed to have received the biggest uptake.

“While specific materials can fluctuate based on seasonality and commodity trends, there's a growing emphasis on technical specificity in ingredient searches,” he told this site.

“Brands aren’t just looking for commodity materials; they’re looking for materials with extremely precise physical characteristics that map to their unique manufacturing environments. Additionally, country-of-origin requirements and factors related to ESG (environmental, social, and governance) and compliance initiatives are influencing ingredient selection.”

Conversely, TraceGains’ report notes that ESG seems to have fallen in importance as a major driver of innovation, with relatively few brands citing sustainability-related themes as significant drivers of product development.

This aligns with themes from financial markets in 2023, in which ESG-oriented investments receded markedly under pressure from regulators, and amid growing skepticism about the legitimacy of ‘green’ initiatives.

However, with regulations covering deforestation, forced labor, and carbon and water impact becoming a common theme in the EU, there’s an increasingly clear expectation that companies will execute due diligence in the selection of individual suppliers, as well as in the creation of end-to-end supply chains.

“As diligence requirements force longer term changes in supply chains and supplier relationships, it’s likely that teams will continue to see product changes resulting from shifts in material availability and cost.”