Amazon's US grocery sales surged 30% to $350m in Q1: 'Young men are the demographic most likely to buy their groceries online'

Speaking to FoodNavigator-USA after releasing a new report on Amazon’s Q1 grocery sales, One Click Retail VP sales and marketing Nathan Rigby said: “Look at Dr Pepper Snapple Group. It’s one of the largest beverage manufacturers out there and it’s non-existent on Amazon… that’s a massive miss.”

“Grocery probably represents one of the largest opportunities for Amazon… the potential is huge.”

He added: “Amazon wants to offer the lowest prices. And I think the smart companies understand that investing in Amazon right now may not deliver the returns they expect on day one, but they have got to take a long-term view. Too many companies are saying, you know, we’ll get to Amazon once it reaches a certain threshold. Well you might as well send a farewell letter to the industry.

“Too many companies are also trying to take traditional bricks & mortar ideas and re-package them for e-commerce, and it doesn’t work. You need to have a dedicated e-commerce strategy.

“Smart companies know all the options available on Amazon and how to take advantage of them, from organic search optimization – because 90% of all purchases begin with search, to paid search, featured deals, sponsored products, and subscribe and save.”

Spreading its bets

While not everything Amazon touches turns to gold, you wouldn’t bet against it because it has such a strategic approach, evidenced by a tendency to try multiple solutions, measure everything, and see what works, added Rigby, whether it’s new checkout-free store Amazon Go, or Dash, drones, Alexa, Amazon Prime Pantry, Amazon Fresh, Amazon Prime Now, curbside pick-up, or partnerships with retailers.

“They are trialing so many different things in order to figure out what works. Maybe they will even buy a grocery retailer such as Whole Foods. They are leaving no stone unturned.”

How different are bricks to clicks?

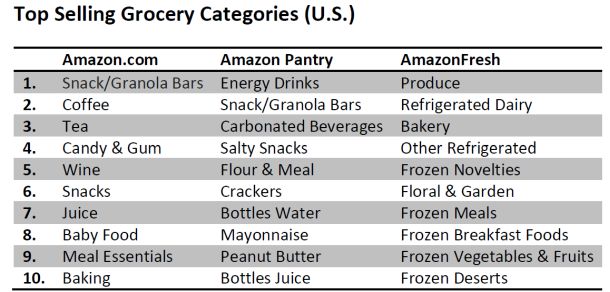

One immediate insight from One Click Retail’s data is that the brands that are growing the most rapidly on Amazon are not necessarily growing the most rapidly in grocery stores, while the top five grocery categories by dollar sales on Amazon (coffee, snack bars, bagged tea, energy drinks, chocolate candy) are quite different to the top five in bricks & mortar: fizzy drinks, salty snacks, RTE cereal, coffee, bottled water.

In some cases, this is because brands in some big categories haven’t grasped how to engage with Amazon, he said, while in others, it might be because some things consumers buy on a regular basis lend themselves particularly well to an online platform, such as coffee pods-serve coffee pods, bottled water and energy bars.

Young men are the demographic most likely to buy their groceries online …

Another notable difference between Amazon shoppers and grocery shoppers in general is the gender balance, said Rigby: “Although online grocery sales are growing across all demographic groups, the largest group is men between the ages of 18 and 44, who are less likely to spend time in a brick and mortar store.

Top-selling categories, grocery, Amazon (US, Q1, 2017):

- Snacks/granola bars +20%

- Coffee +35%

- Tea +15%

- Candy and gum +25%

- Wine +115%

- Snacks +40%

- Juice +35%

"In the US, the majority of men in this age group have purchased groceries online and the bulk of consumers who have are satisfied with their experience and plan to do so again.”

Alcoholic beverages are also “helping to drive the adoption of online grocery shopping especially among young men,” he added.

“Young men are the demographic most likely to buy their groceries online. Younger generations, who are already more comfortable with e-commerce, are remaining single further into adulthood, and the men of this particular group are opting to avoid a trip to the store by buying their food from Amazon.”

Amazon LaunchPad is designed to showcase innovative young brands via a more streamlined onboarding experience, custom product pages, a comprehensive marketing package, and access to Amazon’s global fulfillment network, and has helped brands such as Soylent - which built up a sizeable online business via its own website before going on Amazon - grow extremely rapidly.

According to OneClickRetail, sales of Soylent - which only launched on Amazon last summer - did nearly $1m through the platform in Q1, 2017 and is now among the top 10 grocery brands on the site.

AmazonFresh

But what about fresh food?

“After a slow 2016, said Rigby, "AmazonFresh, a subscription service ($14.99/month) which gives subscribers access to same-day or next day home deliveries of groceries, had a successful first quarter in the US, initially offering primarily non-perishable items [in Seattle, California, New York, and Philadelphia]. In Q1 2017, the increasing inventory of perishables brought in $10m in sales, with produce and dairy climbing to the top two best-selling AmazonFresh categories.”

Amazon Prime

Right now, however, the big growth story for online grocery sales is Amazon Prime, whereby users [and there are more than 65 million of them] pay an annual fee, but get free delivery on their orders, added Rigby. (For Amazon Prime Pantry, you must order at least five items to qualify for free delivery.)

“More than half of Amazon Prime members have already bought groceries through the [Pantry] service, which in certain jurisdictions is now offering alcoholic beverages as well and are, along with young men, the largest growth driver in the online grocery sales markets in the US and the UK.”