Meal kits may increasingly bite into grocery meat sales, Nielsen data suggests

The meat sector is still recovering from a rocky road that started in 2012, when the Midwest experienced a severe drought that raised the price of feed, “a catalyst to beef supply challenges we’re still facing today,” Nelson said during the webinar (which can be viewed on demand HERE).

Add to that the consumer concerns about lean finely textured beef, the PED virus in pork, an all-time-low for cattle inventory in 2014, and the avian flu outbreak in 2015, the meat sector has taken a beating. But there are new obstacles today that are pushing the industry to really rethink long-established practices.

Protein competition from non-meat aisles and meal kits

Across the store, protein claims are increasing and “getting more credit than meat,” Nelson said. There are 39% more food items with protein claims now versus four years ago.

In fact, about half of shoppers don’t perceive meat as high protein, and 78% of shoppers overestimate the protein content in peanut butter, she said.

Another area that is increasingly proving to be competition for grocery store deli and meat sections is the booming meal kit market. A quarter out of 2,015 respondents in a recent Harris Poll survey said they had purchased a meal kit in the last 12 months (the survey was conducted online between December 27 - 29, 2016). Additionally, Nielsen’s data showed that the biggest draw to the meal kit category was education (in this case, learning how to cook). Retention rates and repeat orders of meal kit companies are increasingly going up, suggesting that the category is poised for continuous growth.

“Who do meal kits pose the greatest risk to? Reality is: everyone,” Nelson said. From the foodservice sector to grocery, Nielsen’s survey results revealed that, among the occasions that could replace meal kit use, four of the top five can threaten traditional grocery stores (62% deli prepared food, 59% homemade meal, 59% snacking for dinner).

How it affects meat specifically? Nielsen’s survey found that 91% of consumers who use meal kits were satisfied with how fresh meat is packaged, and that 28% of millennials would prefer to make Thanksgiving dinner from a meal kit—two findings that suggest meal kits can increasingly be a source of meat consumption among consumers.

Production claims: Grass-fed, humane, hormone-free drive purchasing

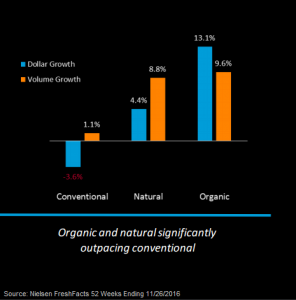

“The meat department [today] is more about how the animal is raised,” Nelson said. The biggest growth in the industry comes from meat with production claims, according to Nielsen FreshFacts data spanning the 52 weeks ending November 2016.

Sales of meat products (beef, pork, and poultry) with no claim were down 3.8%. Meanwhile, 'grass-fed' claims led the pack with a 16.1% sales increase (and 20% increase of volume), joined by 'antibiotic-free' with an 8.5% sales increase. “In sheer dollars, we saw meat with any claim grow $300m dollars last year,” Nelson said, adding that it was responsible for nearly 40% of the volume growth.

The claims are viewed favorably by consumers. According to a Nielsen Homescan Panel back in November 2016, ‘hormone-free’ claims had a great impact on likelihood to purchase fresh meat, as 53% said they were more likely to buy if the label is on pack. It tied with antibiotic free, and was followed by grass-fed (40%) and all natural (39%).

But Nielsen also found that ‘antibiotic-free’ was one of the most misunderstood claims. Though USDA standards say antibiotic free means ‘no antibiotics ever,’ 56% of surveyed respondents thought it meant the animal wasn’t given antibiotics in final few months.