Disrupt or die: Big Food is at a crossroads, says Hartman Strategy

In a new Hartbeat Exec report, Hartman Group CEO Laurie Demeritt and James Richardson, Ph.D. SVP, Knowledge & Innovation, at Hartman Strategy argue that “The allure of younger, especially premium, brands is connected to a profound bifurcation of values around food that we have been quietly tracking for twenty-five years”.

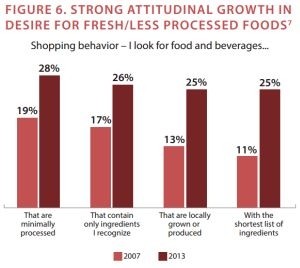

And while some truly iconic brands are great at staying relevant, consumers are losing interest in some of the brands and products their parents grew up with, which might explain why promotional spending on these brands does not seem to be generating the volume uplifts it used to, say Demeritt and Richardson.

“The emerging mindset points to the single most overlooked and uncomfortable truth in the packaged food industry: The underlying challenge behind low top-line growth in food is increasingly the food and the symbolic quality halo of old brands, not price, not placement and not promotional/marketing mix.”

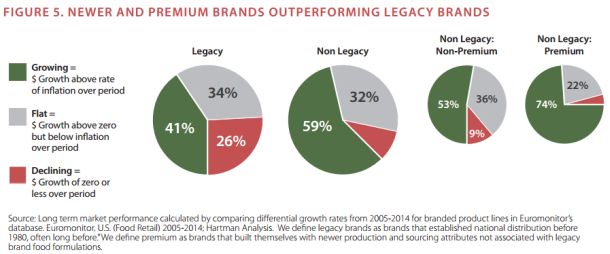

Premium, high-priced emerging brands and foods and beverages are consistently some of the best performers

As for price, they note: “Pricing super-low is not creating reliable growth for established brands. The majority of non-premium traditional food brands pricing at or even below private label averages are actually declining in our sample of categories.”

Meanwhile, premium, high-priced emerging brands are consistently some of the best performers, they say. “Brands anchored in this segment have such rarity and distinction that they will attract top $ and organic growth in today’s market.”

Indeed, they add, “Even many growth segments with 100%+ price premiums are growing well (at least while these brands are small), suggesting that the market is rewarding very high-priced innovations that utilize high price as part of their symbolic argument for quality among early consumers.

“Moreover, these brands set themselves up for a better margin situation down the road by starting high, rather than thinking a low price will get them either better growth or volume early on.”

If your brand is not respond to traditional kinds of fix-it investments, stop overinvesting in it

So what should larger legacy brands struggling to generate organic growth do?

First, face facts, they say: "If your brand does not respond to traditional kinds of fix-it investments, stop over-investing in it,” and put your money to better use – by investing in brands and categories that are growing.

“We believe that organizations that have effectively let go of legacy brand bias in their internal cultures are better able to minimize reinvestment where the brand doesn’t respond, sustain it where it does and deploy the rest of the cash cows’ profit pool into aggressive investments in the growth pockets we’ve outlined.”

So how and when should they invest in innovative new brands?

“We believe that a mix of M&A and minority investment is critical to tapping into opportunities. More and more M&A teams are now looking at premium brands, so the earlier in the life cycle you begin networking and securing a relationship, the more you can avoid a bidding war.”

Similarly, strategic buyers/investors should not dismiss white spaces that might seem too niche to be worthy of consideration, they add: “Let Chobani be a lesson that cleverly executed premium go-to market strategies do allow for formerly small growth segments [e.g. Greek yogurt] to become huge relatively quickly.”

Existing corporate brand portfolios are not well-optimized to tap into market extremes

But why not develop their own innovative products in emerging categories rather than buying in innovation?

It’s rarely an either/or situation, and a lot depends on how much time they have and how much risk they are willing to take, say the authors. However, consumers can be suspicious when big corporations or traditional mid-market brands venture into new territory.

“Existing corporate brand portfolios are not well-optimized to tap into market extremes… If they try to extend upmarket, they may not have the appropriate brands to be credible purveyors of premium quality distinctions.”

Many ‘innovations’ from big brands are ‘basically not that innovative at all’

Meanwhile, the evidence also suggests that larger companies are not typically behind the most innovative new products, they add.

“When we recently looked at innovation from CPG food and beverage companies in 2014, we found that 92% of launches we sampled fit into a very conservative definition of innovation. New products that tap into traditional American food preferences do not challenge existing revenue or supply chain models and are basically not that innovative at all.”

Click HERE to download the full report: U.S. Packaged Food at a Crossroads