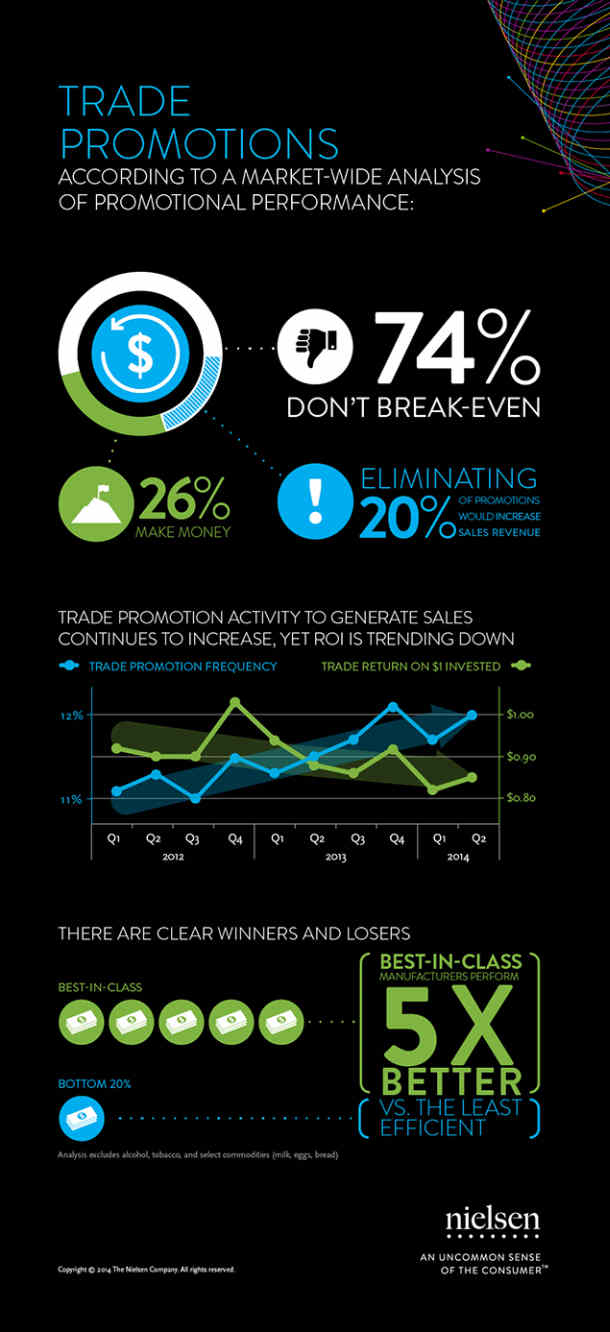

Three-quarters of CPG promotions don’t break even, says Nielsen

In a review of more than one million UPCs and 39 million promotional events totaling $555 billion in U.S. retail sales across 150 retail banners, Nielsen found that almost three-quarters of promotions don’t break even.

The analysis follows the publication of a survey of 20 leading CPG firms by consultancy Strategy& in which 85% of respondents said they were spending too much on trade funding; more than 50% felt their trade funding program was “ineffective” and 70% were unhappy with their planning and execution tools.

Caught in a promotional trap?

Many food & beverage CEOs have also expressed their frustration with the promotional trap they feel they are caught in right now, with Kraft Foods boss Tony Vernon recently telling analysts that trade spending was not delivering in the way that it used to.

He added: “Right now, industry returns on promotional activities, innovation, and even product renovation are lower than what we’ve seen in the past.”

Despite the pressure to turn on the trade spending nozzle to meet quarterly targets and retain market share, he said, “I think all of us have to realize that it’s not the long-term way to run a business. A long-term way is to innovate and offer a real value to a consumer and that’s where we got to go.”

Trade spending is not a cost of doing business, it’s a strategic investment

While larger companies have access to promotional planning tools designed to help them plan, execute and evaluate promotional activity, smaller firms often fail to track what they are spending their money on, Bob Burke from Natural Products Consulting told delegates at the recent BevNET food & beverage university event in Los Angeles.

And given that early-stage firms can spend up to a third of their sales on promotions, slotting fees, allowances, table top shows, demos and distributor ads, it’s remarkable how few of them have a handle on what their hard-earned money is being spent on and whether it could be better spent elsewhere, he said.

So “start with a simple spreadsheet” and track what’s been agreed, with whom, when, and then check the follow through, he said: “Trade spending is not a cost of doing business, it’s a strategic investment.”

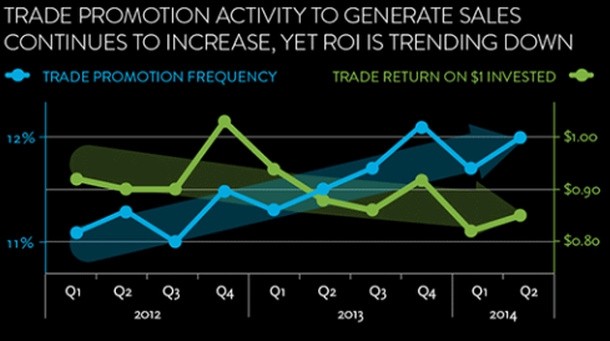

Check out the Nielsen infographic below for more information.