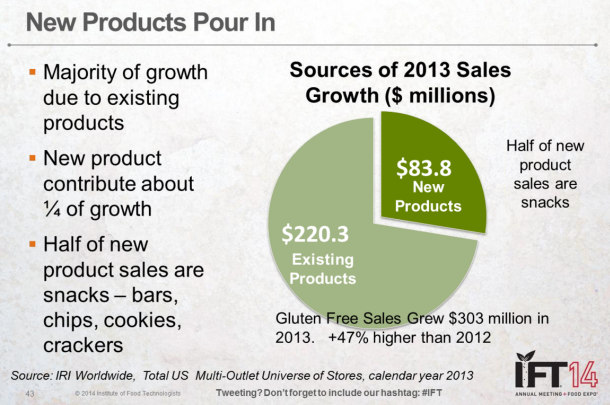

Half of new product sales in gluten-free are from snacks, but are we close to saturation point?

Speaking at a webinar hosted by the Institute of Food Technologists (click HERE), Ardent Mills’ director of commercial insights David Sheluga PhD said:

“There was a lot of new product activity in 2013, but the only thing I’m a little bit worried about is that about half of the new product sales are in cookies, crackers, salty snacks and snack bars.

"We’re starting to get a bit saturated I think with [gluten-free] snack products.... I’d like to see a little bit more distribution of other types of product categories.”

Gluten-free is big, just not as big as you’ve been led to believe

As to the much-debated size of the US gluten-free retail market, while Mintel reckons it topped $10bn in 2013, its data includes anything with a gluten-free label (including products that might be naturally-gluten-free).

If you limit the definition to products that have been specifically formulated to replace wheat and where gluten-free is “not just a minor claim among a bundle of others”, the market was probably closer to $1.2bn in 2013, said Dr Sheluga, noting that 70% of these sales were driven by heavy buyers, who account for just 3.8% of US households.

“Gluten-free is big,” said Dr Sheluga. “Just not as big as you’ve been led to believe.”

The top-selling gluten-free categories were: Crackers ($156m), salty snacks ($125m), bread & rolls ($120m), pasta ($78m), cookies ($60m), baking mixes ($55m), RTE cereal ($49m), ancient grains ($47m), snack bars ($45m), flour ($43m), and frozen pizza ($35m).

Ardent Mills remains ‘pretty bullish’ about gluten-free category growth

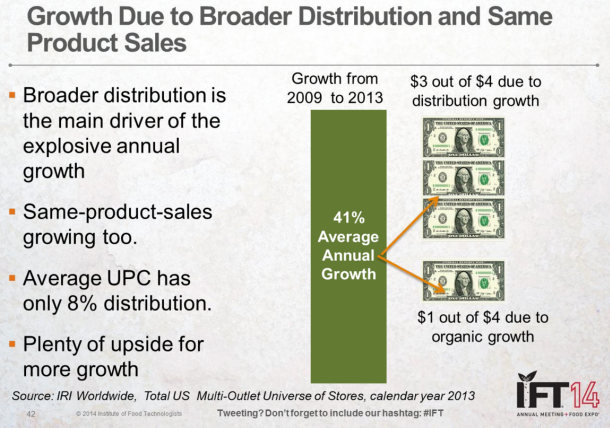

Addressing the issue of whether the gluten-free bubble might burst, he said that Ardent Mills was “pretty bullish” about the sector’s prospects given that the average gluten-free product on the market today has only 8% distribution.

“There is a lot of headroom above where we are at today.”

It is also encouraging that almost three-quarters of gluten-free products on the market in 2009 are still selling today, whereas 85% of new products launched in the overall grocery market quietly disappear from shelves after two years, he observed.

As for general consumer sentiment tracking, there has been a huge surge in google searches for ‘gluten’ or ‘gluten-free’ over the past decade, while searches for ‘organic’ (food) have remained pretty consistent, said Dr Sheluga.

(The number of searches for ‘GMO’ rose dramatically in 2012-2013, but the numbers are still dwarfed by the number of searches for gluten, he noted.)

You often hear that once one person goes gluten free, the whole household goes gluten free. That’s just not true

However, market watchers should exercise some caution, he noted: “What might slow down the growth [of gluten-free]? One [factor] is that worry about over saturation in snacks. Are we reaching a breaking point where we can’t eat any more snacks?

“Two, we do know that the medical needs audience [people with celiac disease and gluten sensitivity] is finite. Third, what happens if grocers reduce shelf space? Fourth, there is a broad swath of the public that is just not interested in gluten-free. And five, we need to keep a watch on the rise of the counter message [those suggesting that gluten-free diets are faddish etc].”

Meanwhile, it is also incorrect to assume that if there is one person in a household diagnosed with celiac disease, that the rest of the household will all convert to gluten-free, creating a ‘halo’ effect, he said.

“You hear often in the news that once one person goes gluten-free they all go gluten free. That’s just not true. Maybe they share a gluten-free meal once in a while, but they are not all going gluten-free.”

Consumers who say they are avoiding gluten are more often just cutting down on bread, carbs

Finally, while most surveys find that 20-30% of shoppers say they are avoiding gluten or buying gluten-free products, follow-up interviews with these consumers reveal that they are not in fact avoiding gluten, but are cutting down on ‘carbs’ (typically bread) for perceived health or weight management benefits, he said.

Tune into the IFT webinar: Navigating the Ingredient Landscape: How Trends Impact Consumer Purchase Decisions.

Click HERE to read more about the gluten-free market opportunity from Dr Sheluga, who also shared insights at FoodNavigator-USA’s recent gluten-free forum (register HERE to watch it on demand).