Banza co-founder on staying focused, raising capital, saying no, and ‘shiny object syndrome’

Speaking to FoodNavigator-USA after raising $7.5m in a funding round led by Beechwood Capital and supported by Strand Equity Partners and RSE Ventures, Rudolph said: “When it comes to distribution, we’ve said no to more opportunities than we’ve said yes to.

“If we’re going to change this category it won’t happen just by being in every store, but being one of the top selling pastas in the store. So we always prefer to further invest in relationships with retail partners than to increase distribution.

"It all comes down to velocity, what works what doesn’t and why, store by store,” added Rudolph, who founded Banza with his brother Scott in Detroit in 2014.

Similarly, while there are clearly big opportunities to grow in the foodservice channel,and Banza has followed up incoming leads, it’s not aggressively courting this market right now, added Rudolph: “We don’t want to great too distracted as our focus is growing the brand [ie. in retail].”

As for brand extensions, he said: “I get excited about building a platform, and there’s a tremendous amount that can be improved upon in food. If we can be a real force for good in the food industry, that’s the long term goal, maybe we become a modern era version of P&G. there’s a lot of different directions we could go in.

“But for now, there’s so much more to do in pasta, and I try not to have shiny object syndrome…”

Banza is aimed squarely at mainstream consumers

Unlike a lot of food start-ups plugging their wares at Expo West and the Fancy Food Show, Banza chickpea pasta – now in around 5,000 stores three years after launch - is aimed squarely at mainstream consumers who are looking for more protein and fiber in their pasta, but are not prepared to compromise on taste or texture, said Rudolph, who has worked hard from the outset to position Banza as a mainstream pasta brand, not a gluten-free ‘alternative’ or a high-end natural foods brand.

And retailers that share that vision – of Banza as a “main category disruptor” – are the best partners, added Rudolph, who said the brand had proved that it can work in natural and conventional channels, in retailers from ShopRite, Fairway and Wegmans to Whole Foods and Target.

“I think some retailers still see products like ours as just variety, which limits the potential, so to start with we were sometimes put in a separate gluten-free section, where we did well, but we’ve proved that when we’re in the main category, we can be one of the top selling pastas in the store.

“We’ve seen 540% year over year growth in Whole Foods, we’re one of two brands sold in Target nationally – it’s just us and Barilla - and that’s been huge for us, and we’re starting to see some really good traction.

“We’ve just launched a lot of new products, so it’s all about going deeper not just wider and doubling down on great relationships, because we want to be one of the top selling pastas in the northeast, so we can take that playbook and do the same elsewhere.”

Keep it simple, stupid

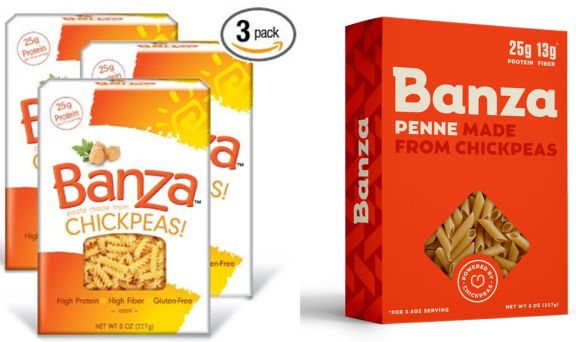

From a merchandising perspective, meanwhile, having a bold, more mainstream look (the bright orange packaging) that emphasizes the brand ahead of some of the attributes has also been important as new players have moved into the market and cutting through the noise becomes even more important.

Indeed, search on Amazon for ‘chickpea pasta’ and you’ll find a surprising number of brands aside from Banza including pasta giant Barilla, Tolerant, Chickapea, Explore Cuisine and Pasta Lensi, although Banza currently has the coveted Amazon Choice moniker in the category, and is listed as a best seller.

“Everyone on our team does demos,” said Rudolph, “so we were constantly talking to our customers and we realized that the pasta set was incredibly complicated – well actually the entire grocery store is incredibly complicated - so we wanted to simplify our branding and our messaging.”

From a financing perspective, investors are also looking for brands that have a clear idea of who they are, where they are going and what the endgame is, he said:

“So of course they want to know topline revenue, gross margins, and how you’re actually doing, but they also what to know your long term vision, your endgame, so it sounds obvious but anyone who is raising money needs to think upfront what do you want to do with your business, and are you and your investor aligned on this?”

Companies we admire the most, like Chobani, make their own products

While it’s unusual for a company that’s only three years old to manufacture its own products, investors Banza was pitching to in the latest round understood that it made sense for the brand, argued Rudolph: “When people first learn we make it in house they are nervous but when we talk through why it happened they understand that it gives us a competitive advantage.

“We were originally working with a co-packer and when we started the product wasn’t as good as we wanted it to be, which was very painful. The product definitely got better as we worked with them, but we saw a transformational improvement when we started making it in house.”

It’s unusual, he said, but hardly unprecedented: “Companies we admire the most, like Chobani, make their own products.”

Continuous improvement

While the recipe – 90% chickpeas plus tapioca, pea protein and xanthan gum – sounds pretty simple, getting the process just right took a long time, and continuous improvement has been the name of the game, said Rudolph.

“We also learned over time that there are certain forms of chickpeas that work for our product and other that don’t, so we’re very involved on the sourcing side even though we don’t do the milling [of the chickpeas] in house,” added Rudolph, who said the latest cash injection will be spent on recruiting new team members, new product development and increasing production capacity.

Launched in Detroit in late 2014 by brothers Brian and Scott Rudolph, Banza - pasta made from 90% chickpeas coupled with tapioca, pea protein and xanthan gum - promises to rival the taste and texture of regular wheat pasta, but has twice the protein and four times the fiber.

Embracing your inner goofiness

When it comes to marketing on a budget, Banza has definitely benefited from having a product that’s innovative, nutritious, and photogenic in the Instagram age where Millennials in particular love to share pictures of pictures of cool stuff they had for dinner, or new brands they see in stores, he said.

Banza has also learned to embrace its inner “goofiness” and not be afraid to build its own voice in social media posts, he said. “Our customers are really embracing it. The great thing about it [social media] is that there are things you can do today as a small brand you just couldn’t do 20 years ago, and if you’ve got something unique, it really does get rewarded.”

Banza revamped its brand in 2016 to help it stand out on shelf (old pack on left, new pack on right) So what do design experts think of its bold orange look?

"Banza is a great example of a brand that is being driven by the new crop of food entrepreneurs who are helping to completely change the food system. They were one of the first to bring function into a stale category and Chobani took notice by bringing them into their inaugural incubator class. We really like the Banza redesign as it provides contrast in a category full of brands playing it safe. It will be interesting to see the pasta category evolve or play catch up as brand take note of the category evolution happening. Ancient Harvest is another functional pasta brand that launched a line extension around the same time the Banza redesign POW! which leads with a clean and colorful design that will definitely stand out in the category as well."

Blake Mitchell, president, Interact Boulder

“I think it's bold and striking and will definitely pop in the supermarket if you get a bunch of them together. But it is lacking in any personality to me. What does the brand stand for? What is its’ personality. You could literally put anything inside that pack, it could just as well be for a drill or paint. For me, packaging should connect to human traits, make us feel something, connect us with the brands mission, its drive.”

Simon Thorneycroft, founder and CEO, Perspective Branding